Analysis of the ophthalmic medical device industry

Ophthalmic medical equipment includes ophthalmic equipment and related instruments, auxiliary devices, and implants used for diagnosing and treating ophthalmic diseases, which can be divided into ophthalmic consumables, ophthalmic diagnostic equipment, and ophthalmic treatment equipment. Generally speaking, the ophthalmic medical device and ophthalmic medical device market does not include contact lenses and care solutions.

Ophthalmic medical devices have a wide range of applications and a variety of types, involving a wide range of upstream raw material products. The upstream raw materials for ophthalmic diagnostic equipment and surgical equipment include electronic components, circuit boards, display screens, optical equipment, laser equipment, etc., while the upstream raw materials for consumables such as artificial lenses and corneal reshaping lenses include XO lenses, silicone, acrylic ester, etc. The downstream consumers of ophthalmic medical devices mainly include hospitals and individual consumers.

The technical barriers in the ophthalmic field are extremely high, and the global market is currently presenting a highly concentrated competitive landscape. Enterprises such as Alcon, Johnson&Johnson, Bosch Lun, and Yishilu have occupied the first tier market. Several leading ophthalmic device companies, including Yishilu, Novartis (Alcon), and Johnson&Johnson (Eye Health), occupy the vast majority of the industry's market share. Their main products are artificial lenses, corneal contact lenses, and ophthalmic examination and treatment equipment. Among them, Novartis (Alcon) is one of the world's largest eye health companies, with global sales of artificial lenses, corneal contact lenses, and other products exceeding one billion US dollars. Oligopoly is evident, with highly concentrated industries, with the top ten accounting for a total of 98% of the market share.

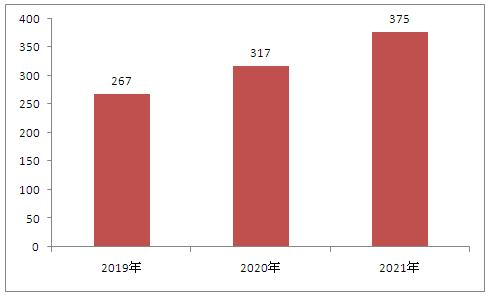

The domestic ophthalmic medical device market is growing rapidly, with a relatively high proportion of foreign products. According to the 2019 Blue Book of Medical Devices in China, high-value medical consumables for ophthalmology mainly include artificial lenses, artificial retina, artificial vitreous, artificial cornea, hard corneal contact lenses, etc. The demand for domestic ophthalmic equipment market is large and growing rapidly: With the increase in the incidence of refractive errors among adolescents and the increase in the number of cataract surgeries in middle-aged and elderly people, the size of China's ophthalmic equipment market has grown rapidly, from 11.1 billion yuan in 2014 to 37.5 billion yuan in 2021, with a compound growth rate of up to 19% in the past five years.

Chart: Market size of ophthalmic medical devices in China from 2019 to 2021 (unit: 100 million yuan)

Data source: Zhongyan Puhua Industrial Research Institute

For high-end ophthalmic instruments, equipment, and innovative ophthalmic drugs, the technical threshold is relatively high, while Chinese manufacturers have a relatively late layout, and there is a shortage of talent in research and development, clinical practice, and sales. Currently, there is still a significant gap in product technology accumulation compared to foreign countries. The ophthalmic pharmaceutical industry is also very similar. Currently, the mainstream pipeline of domestic ophthalmic pharmaceutical companies is still dominated by generic drugs and improved new drugs, with relatively less independent research and development, and very serious homogenization, resulting in a significant improvement in the gap between domestic and foreign drugs.

The proportion of domestic and foreign pharmaceutical companies in the domestic ophthalmic drug market is about 60% -70%, and 80% of the market share in high-value ophthalmic consumables is monopolized by foreign enterprises. Looking at the field of ophthalmic medical equipment, the proportion of foreign brands has reached about 95%. In recent years, although domestic enterprises have been expanding into the ophthalmic market, due to their late start, it still takes some time to accumulate and make initial breakthroughs.

Although the number of patients with ophthalmic diseases in China is much higher than that in the United States, the current awareness of treatment among patients is relatively weak. Compared to the United States, the diagnostic rates of major mainstream ophthalmic diseases vary greatly. In addition, although the attention of the capital market to the ophthalmology market has gradually increased in recent years, there is still a lack of understanding, especially limited understanding of the implicit market space brought by cutting-edge products. Finally, for more cutting-edge fields such as cell therapy and gene therapy, the lack of relevant products in China has led to unclear regulatory and approval laws and regulations in the current market, which has brought certain difficulties to enterprises at the forefront.

Accelerated pace of domestic substitution

For many years, the core equipment in the field of ophthalmic medical devices has been monopolized by imported products due to high technical barriers; But with the expansion of China's ophthalmic medical device market and the acceleration of innovation and research and development by related enterprises, the process of domestic substitution in China's ophthalmic medical device industry has begun. Some manufacturers are accelerating their entry into the mid to high end ophthalmic medical device market, achieving significant breakthroughs in the fields of artificial lenses, corneal contact lenses, and other products. In addition, the country has actively introduced relevant policies to support the localization and alternative development of the medical device industry. In October 2021, the Ministry of Finance and the Ministry of Industry and Information Technology of China issued relevant policies that clearly stipulated the proportion requirements for government agencies to purchase domestic medical devices and instruments. Among them, all 137 types of medical devices, including fundus cameras and dry eye detectors, are required to purchase 100% domestically. With the support of technological progress in enterprises and national policies, the pace of domestic substitution in China's ophthalmic medical device industry will accelerate in the future.